Rising Costs, Record Keeping, and Investor Trends: Bronx Real Estate Investment Market Overview for 2024-H1

By Marco Lala, Managing Director at RM Friedland

July 2024

With COVID-19 now a distant memory, the commercial and retail asset classes have made a significant rebound. Properties with regional or national tenants are in high demand, as are neighborhood retail spaces in strong corridors. Mixed-use properties with stores on the ground floor and free-market units above, as well as single-story, multi-tenant 'taxpayers’, are especially popular. Demand for larger free-market multifamily remains high, though it has been somewhat tempered by the recent signing of the Good Cause Eviction Bill. Now, landlords must renew existing leases and are capped at increases of the lessor of 5% + CPI or 10% (unless the tenant moves out or other exceptions apply). The implementation of the 485X tax abatement has also spurred land sales. In areas like the Bronx, it is critical to stay under 99 units as costs begin to escalate due to wage requirements and other demands on developers.

Regarding supply, my brother and longtime partner, Jack Lala, believes, 'The current environment following all of the restrictions, circumstances, and laws that have taken place since June 2019 has led many owners who have been in the business for decades to consider retirement more seriously or to cash out and move their investments elsewhere. This shift has allowed other seasoned and experienced investors to grow their portfolios and purchase properties that would have never otherwise hit the market.”

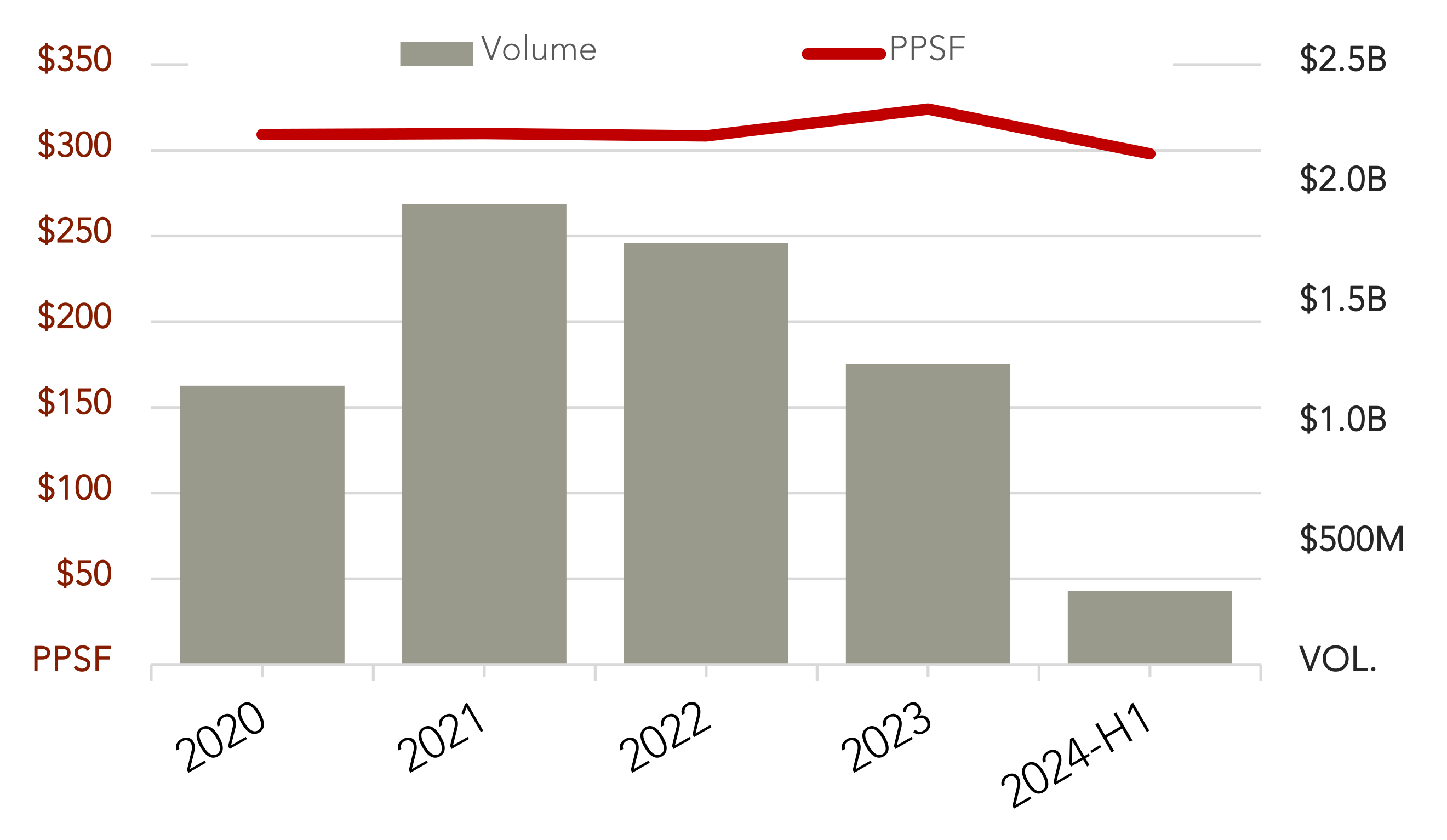

Bronx Volume & PPSF

Source: RM Friedland 2024-H1 Investment Sales Reports

Lending Standards and Financing Volume

Since the collapse of Signature Bank and NYCB requiring a cash injection from private equity, lenders have become extra cautious. Their inspections and coordination with other third-party vendors like insurance companies, engineers, and environmental consultants have been tremendously heightened. They are now monitoring city websites like NYC.gov and HPD for any changes in violation counts, lead paint issues, or other red flags made public. The higher rates have obviously tempered loan amounts. The regulatory environment and rising operating costs are also making DSCR ratios higher and bps spreads wider. I don’t see the data suggesting a rate cut of any consequence for the remainder of the year, but there appears to be a consensus of a rate cut in September. The hikes were very high and very quick, and a quarter-point decrease may not fix anything in the short term other than providing a psychological benefit."

Jack adds, “Despite the challenges deals can still reach the finish line. It's important to have your paperwork in order and maintain good communication throughout the entire process. If you have good relationships with sellers, buyers, attorneys, and mortgage brokers, and maintain clear communication, it greatly facilitates the process.”

Operating Expenses and Asset Management

Besides lending criteria, the rising utility costs, insurance, and other operating expenses are making it very difficult for owners to reinvest in their buildings. In addition to anemic rent increases, reserves are being tapped into just to pay the bills. A minor fix-up versus a total gut rehab is typically the only way an owner can justify getting an apartment unit 'rent-ready' for new tenants. Or worse, an owner might be blindsided by an emergency repair to the roof, boiler, or electrical system. Take insurance, for example. We've seen increases ranging from 50% to even 200% at renewals. How does one underwrite this in their 'opinion of value' or financing illustration? Now apply this to three, four, or more expense line items, and you can see how values could drop 25-50% from the heights of the market.

My daughter and teammate Michelle Lala points out, "Rising costs have taken a toll on landlords. Many are faced with serious business decisions about whether they can carry all these increasing expenses while hoping their tenants actually pay their rent. Landlords now face the tough decision of buckling down and trying to find ways to lessen their financial burden by taking on fewer projects, revamping their management style, or outright selling the property. I have personally had clients sign listing agreements a day after receiving a quote for their new insurance policy."

Managing Risk

Property management and an extreme 'all hands on deck' approach to running one’s properties are more important than ever. This includes shopping for insurance quotes, internalizing some repairs, staying on top of non-payers, and ensuring lead paint repairs are done minimally, possibly getting units 'lead exempt' on city records. Those who use 'third-party' managers must 'manage the management company' by scrutinizing every monthly report. It's crucial to actually go out and walk the properties on a regular schedule, both with and without your property manager. This approach can lead to cost savings or preventative measures should something come to your attention.

Michelle adds, "There are so many challenges and risks to keep track of that can occur unexpectedly. Owners have to stay on top of their paperwork now more than ever, do their best with preventative maintenance, and keep an eye on expenses, shopping around for competitive rates where possible."

Multifamily Challenges

We recently sold an apartment building where a 'rent freeze' from DHCR was identified during due diligence. A contentious back-and-forth ensued with the buyer pushing for a six-figure price reduction on a $9M deal. With the rent freeze starting in 1989, regulations indicate that every rent charged from that point to the present was technically illegal and could lead to an 'overcharge' claim. Although technically capped at six years, a judge can rule otherwise, potentially leading to hundreds of thousands in fines and back rent. Upon further investigation, it was discovered through paperwork dating back to 1991 that the rent had actually been restored and a decision in favor of the landlord was made. Who would think that something misfiled over 35 years ago could detrimentally affect the value of an apartment building?

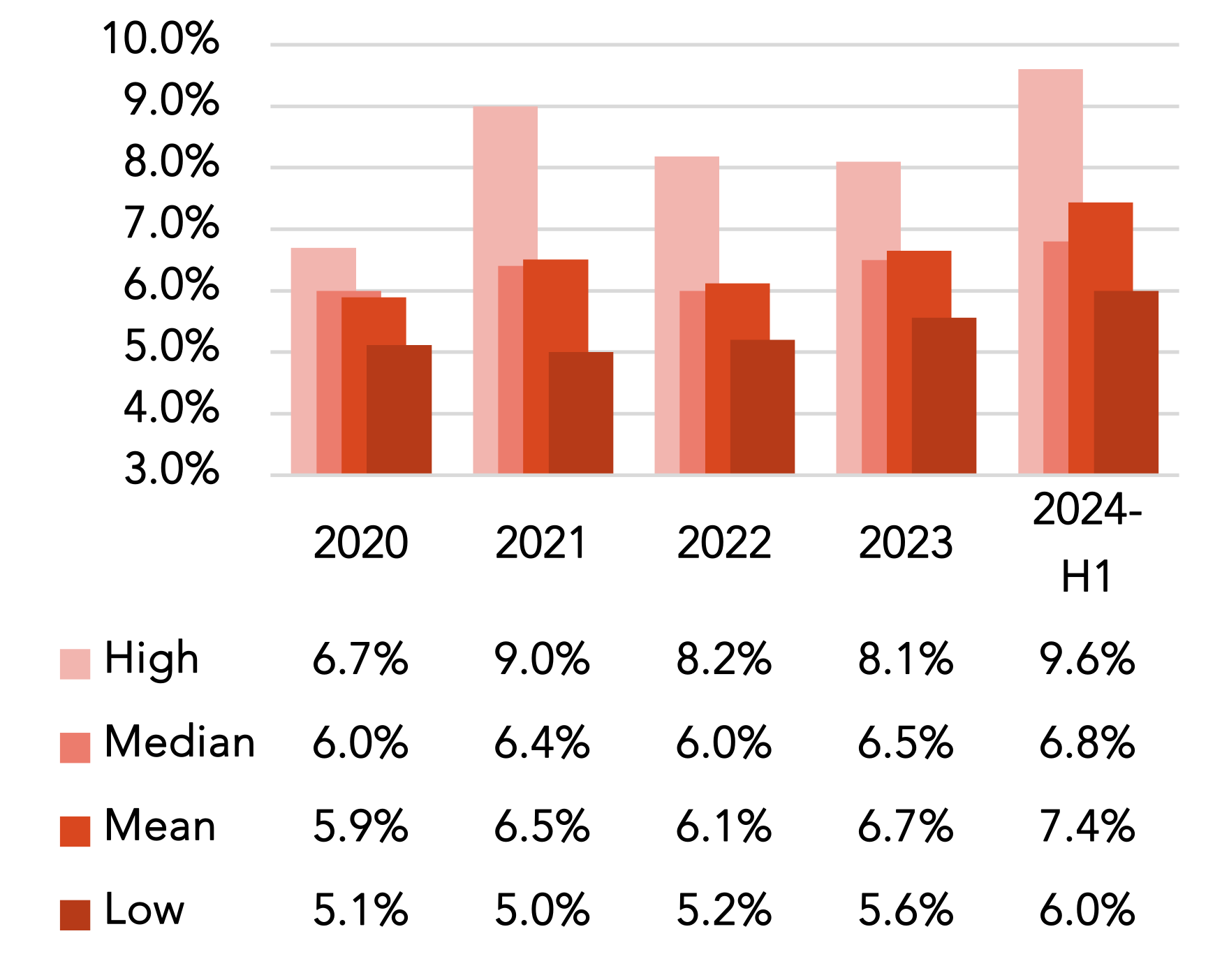

Bronx Multifamily Cap Rates

Source: RM Friedland 2024-H1 Investment Sales Reports

Conclusion

Despite current market challenges, now remains a favorable time to list properties. Stable demand, coupled with a low inventory, creates a strong atmosphere for sellers to achieve competitive pricing and favorable terms.

About Marco Lala

As an investment sales broker with almost three decades of experience, I have facilitated over $1.7 billion in sales throughout the New York metro area. My expertise spans various asset classes, including multifamily, mixed-use, and development sites. My extensive network and deep understanding of market dynamics have enabled me to consistently achieve record-breaking sales. For more information...

Visit: TeamLalaCRE.com

Call Me: (914) 380-3806

Email Me: mlala@rmfriedland.com

The information on this website has been secured from sources we believe to be reliable, but we make no representations or warranties, expressed or implied, as to the accuracy of this information. References to square footage, age or any other metrics are approximate. You bear all risk for any reliance you place on this information. In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage arising out of, or in connection with your use of, or inability to use, this website. Through this website you are able to link to other websites which are not under the control of team.lalacre.com. We do not necessarily recommend or endorse the views expressed within them, and we have no control over their content.