SPECIAL REPORT

How to Not Lose $13,000,000

When You Sell Your Building

the

DEADLY

MISTAKES

Building Owners Make

When It's Time to Sell

...and How to Avoid Them

Read this online, on your phone or device at teamlalacre.com/4g996dg

Insider tips on how to sell your property for the highest price, in the shortest time with the least amount of brain damage

MARCO LALA

Top Grossing Commercial Real Estate Sales Expert

Table of Contents

I| Preface

II| Introduction

III| Case Studies

IV| Mistakes

V| Conclusion:

Real Estate Sales Person Versus

Investment Real Estate Marketing Strategist

A Special Report By Marco Lala

How to Lose $13,000,000 When You Sell Your Apartment Building.

“The Deadly Mistakes Building Owners Make When It’s Time To Sell… And How To Avoid Them”

Copyright Notice

Copyright © 2014, Marco Lala.

All Rights Reserved

Any unauthorized transfer, use, sharing, reproduction or distribution of these materials by any means,

electronic, mechanical, or otherwise is strictly prohibited. No portion of these materials may be reproduced

in any manner whatsoever, without the express written consent of the publisher. Published under the Copyright

Laws of the Library of Congress of the United States of America, by

Marco Lala

www.teamlalacre.com

PO Box 469

Lodi, NJ 07644-0469

914-843-3535

Legal Notice

While all attempts have been made to verify information provided in this publication, neither the author,

nor the publisher assumes any responsibility for errors, omissions or contradictory interpretation of the

subject matter herein. This publication is not intended for use as a source of legal or accounting advice.

The publishers want to stress that the information contained herein may be subject to varying state and/or

local laws or regulations. All users are advised to retain competent council to determine what state and

local laws or regulations may apply to your particular business or circumstance.

I| Preface

When I released the first edition of this special report in 2001, I was amazed at how many millions

and millions of dollars property owners were underselling their buildings for.

West End Ave

Nothing has changed much.

Back In March of 2012, this beautiful 134,000 Square Foot building on West End Avenue on the Upper West Side of

Manhattan sold for $55,634,021 through one of my competitors.

“So what,” you say?

About 4 ½ months later, the same building sold for $68,300,000! There was no drastic change in market, interest

rates, tenants or physical improvements. That makes not ONE, but TWO “off market” deals where a lack of seller

representation resulted in one of the deadliest financial mistakes I’ve seen a seller make in years for a

“single-asset” real estate transaction.

$68,000,000

$55,000,000

Let’s look at that again:

That’s nearly $13,000,000 left on the table by the original seller.

I don’t care if you did a 1031 exchange or not, making an additional $13,000,000 would offset a tremendous amount of

exposure in nearly every area of financial planning and tax mitigation. …and as astonishing as this example is, it

happens nearly EVERYDAY in this business. Let me explain what’s even more shocking. While marketing a $100 million

portfolio of properties in a neighboring submarket, I asked the new owner… (Yes, the new owner that paid $68,300,000)

if they would take an offer between $80 to $90 million. They were more than happy to just keep the building and enjoy

the $10 to $20 million in equity they already “earned” by just closing and keeping this ONE deal! I wake up every day

shaking my head thinking of how I could have added 10, 20 even 30 million dollars to that original owner’s ultimate

sales price. It’s one more exciting reason to get to work every morning!

As you keep reading, you’ll see a disturbing pattern in the many case studies I’ve outlined in this report. I call it:

a lack of Seller Representation due to “hard headedness”. My Italian mom would call it “capa tosta”. (a phrase I was all

familiar with as a kid growing up in the Bronx)

Eat your vegetables.

For many owners, the concept of “seller representation” is like one of those worldly truisms that we all nod our heads

in agreement with when we hear them, you know, like:

“Diversify your portfolio” or better yet, “Eat your vegetables”.

It’s pretty much “in through one ear and out through the other”.

My objective in this special report is to try and get you to metaphorically “eat your vegetables”… and quite possibly

help you earn hundreds of thousands, if not millions on the sale of your next property.

For nearly 2 decades, I’ve been a top producer at WRA Properties, a managing partner at Massey Knakal Realty and now

I’m a senior broker at RM Friedland. I’ve witnessed the highest levels of “seller oriented brokerage” in the

country by past and present colleagues. These brokers have been responsible for selling 10’s of billions of dollars of

commercial real estate- and in every kind of “up or down” market.

Whether I was helping build a territory system, selling a triple net leased deal or co-broking with one of my competitors,

I’ve had a “behind the scenes” view of what works and what doesn’t.

My first real estate instructor at the Community Real Estate School in the Bronx used to say: “I’ve seen The Good, The Bad

and The Ugly!” I can confidently say I’ve seen my share of the same.

Besides my formal education and training, there is another unique aspect of my past that has given me an edge in this

competitive arena.

You may know about my Real estate brokerage background, but do you know about my extensive Martial Arts background?

(See www.fightingsecrets.com for live fight footage)

With over 30 years of training, teaching and competing, I’ve developed a “Sun Tzu-like” approach to my real estate brokerage.

I guess you can call it “Black Belt Brokerage”.

Sun Tzu

I consistently strive to identify how my competitors are weak… and how I can utilize their strengths and advantages into

my personal business plan. The same way a warrior evolves and sharpens his skills.

In Sun Tzu’s book of military strategy, The Art OF WAR, knowing your enemies strengths and weakness were imperative in

improving the odds of victory. The lesson goes, “To know your enemy, you must become your enemy.”

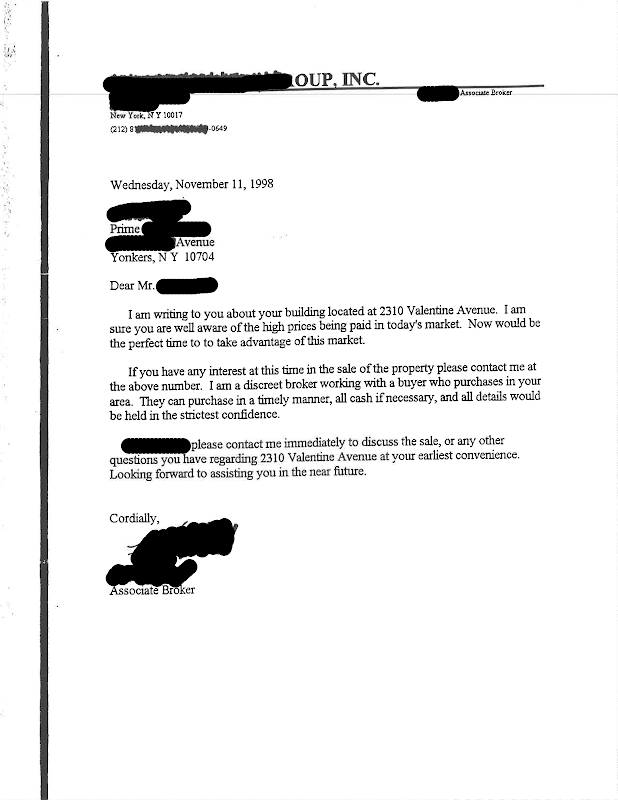

You will see by copies of actual solicitation letters from my competitors the lengths some brokers will go to make you

act irrationally.

My “Art of War” approach to brokerage has helped me hone an effective plan for achieving a maximum sales price with time

tested results. I call it The SMP Method* or Strategic Market Penetration.

I believe my method of SMP* has to be one of the most effective means of price maximization. Many firms have touched upon

one aspect of this system or another, but none have really integrated these techniques in such a systematic approach like I have.

You’ll see the many impressive results of my SMP* techniques in the case studies throughout this report, but if you want

talk about it personally, feel free to call my cell phone right now… 914-843-3535.

Besides the ‘real world’ experience of brokering hundreds and hundreds of buildings,(see a partial list on our team’s

interactive map of sold properties at www.teamlalacre.com) I’ve also had to figure out a way to convey the subtleties

of brokerage success in a training environment as a manager and occasional mentor. When one teaches, it helps crystalize what

I call the ‘best practices’ of top agents.

The many workshops I’ve conducted on negotiating, underwriting and marketing commercial property during my managing partner

days was an experience that has been both rewarding and fulfilling. By integrating “theory” in the classroom with “application”

in the real world, I’ve been able to formulate an approach to selling commercial property that my clients have benefited from

time and time again.

In this updated version of my report, I’ve added additional tips, words of advice and new case studies of many owners who have

suffered the deadly financial mistakes I outlined earlier when they sold their property… and the owners who avoided them.

II| Introduction

New York Real Estate

The New York real estate market place is one of the most difficult and competitive arenas in the business world. I don’t

care if you’re talking about brokerage, managing and owning properties or even running a hotdog truck. There are few

municipalities that even come close to NYC’s highly regulated and demanding business environment

Just think… Thanks to former Mayor Mike, you could have broken the law serving a large cup of soda before common sense

actually won over in the court system.

Here’s a challenge for you… try naming how many government agencies and with all their rules and regulations that a typical

landlord deals with in the course of managing the average apartment property:

HPD, Board of Health, DHCR, ECB, DOB, DEP, Water Dept, Tax Dept, Rent Control Board, ERP, Dept of Sanitation,

Zoning & Code Enforcement, RPIE, Section 8, SCRIE, FDNY, NYCHA, LOFT Board, Landmarks, IMD tenants, civil rights &

discrimination, and on and on… then start adding to that things like Property insurance requirements, Con Edison (or your

respective utility company) fuel/heating requirements, plumbing, electrical, local law 11, oh… and the glamorous Landlord/tenant

court system… Well, you get the picture.

Now, as a broker, try listing and selling properties in this environment… and all while having to follow your own set of rules

and regulations from the Dept. of State which governs the real estate brokerage business.

This special report is my attempt to simplify the dynamics of the selling process with a few real life war stories… and how

these experiences could add thousands of dollars, and in some cases millions of dollars, to your bottom line.

As a new agent, the concept of seller representation was just a theory to me. Something I heard about in training. It wasn't

until I was scanning the “daily transfers” that I looked up a recorded sale by an owner who didn’t return any of my phone calls.

I discovered that he left about $500,000 on the table when he closed on his one and only property in the Bronx.

Having made very little money early on in my career, I couldn’t imagine someone losing almost half a million dollars in ONE

transaction. That sounded like life changing cash… How would MY family have reacted?

I knew that half a million was AT LEAST the amount of extra money I could have generated for him if he just kept an open

mind to meeting with me. You may be asking yourself… How did I know for sure?

A little later in my chapter on "Case Studies," I’ll show you where I actually generated this huge premium for a neighboring

owner right on the same street! It was an identical property which I sold during the same time frame and it went for almost ½

a million more!

And…all that owner did was agree to meet with me for 10 minutes.

It was at this short meeting that I was able to open up his mind to a whole new approach of maximizing the sales price

of his property. No high pressure, no B.S. sales pitch… just listen and do nothing.

And to the owner who never called me back, I would have simply explained the same unique process of selling investment property at a

“top of the market” price, in the fastest time possible and without all the brain damage usually associated with the selling process.

If you break it down, that 10 minute meeting resulting in a $500,000 premium would have been worth $50,000 per minute to that seller!

Not even an internet stock or ‘insider trade” could compare with that "return on investment".

OK, I get it. Sales people bother you every day. Many owners have been jerked around by plumbers, electricians, city agencies

and their inspectors, even the “professional” tenant. So why then give a pesky broker even 10 minutes of your valuable time?

As an owner myself, “I can feel your pain”.

What if I could prove to you that for every minute you gave me, I can add almost $50,000 to the sales price of your property?

(Or maybe that number is $1,300,000 per minute like it could have been for that unsuspecting seller of the West End Ave building!)

With so much money on the line, how many minutes would YOU give me?

Think losing half a million is bad enough? What about getting tied up or stuck in litigation?

There was another owner, who under the advisement of his attorney, entered into a contract to sell his 16 family in Brooklyn, NY.

I’ll refer to him as "All tied up and nowhere to go!”

A Brooklyn building owner I just canvassed was moving out of state and tried to sell his apartment building on his own. He was a

“For Sale By Owner” or FSBO (fizzbo) as they’re called in the business.

Lava Flow in Hawaii

For Sale by Owner

I can still hear his voice ringing in my head. “I don’t need a broker. I have the perfect buyer and my attorney will handle

all the negotiations."

They accepted an offer from a neighbor who was bugging them to sell for years.

Trust me… I don’t think there’s ever been an investor who wouldn’t want to “steal” a neighboring property, and with no

competition from outside investors to boot! The chain of events that followed was easily predictable when he couldn’t

answer some of my simple “qualifying” questions about the buyer.

While hoping for a quick closing, the seller was now held hostage by this "motivated" apartment building buyer who was

stalling and renegotiating the terms of the original contract before the closing date approached.

Unfortunately, the long wait and a threat of starting litigation caused the contract on a new home the Brooklyn owner

was buying in Washington to fall through, and his kids were going to miss the first few months of classes in their new

school… Even if they did litigate and win, how long would that take?

They had to take a big hit on the price to facilitate a quick close and avoid a potential yearlong litigation.

What happened to that perfect deal …and the lawyer who negotiated it? What if the stakes were higher?

Imagine you were selling 10’s of millions of dollars’ worth of real estate and you had identified several 1031 exchange

properties all over the country that you now, all of sudden, couldn’t close on? I’m sure you get the picture now.

If I just had 10 minutes with Mr. “All Tied Up and No Where to Go,” He would have discovered that my SMP method not only

would have generated a premium price, but created what I call a "silent bidding environment"… a way to dramatically

INCREASE the probability of ‘deal certainty’.

DEAL CERTAINTY through the “silent bidding environment” is one of the most effective tools in the commercial

real estate brokers “tool box”. This method, however, can be abused and totally backfire if implemented by a less experience

agent. You can compare it to auctioning off a “collector” car or oil painting, but with my version of a real estate twist.

Brokers and Lawyers are trained differently and must act like two wheels of a bicycle. (A metaphor used in the Martial Arts

world when discussing a combination of striking and grappling arts like Karate and Judo!)

Now imagine a similar strategy: Blending the legal and business point mindset for maximum synergy.

Besides a powerful “silent bidding environment,” imagine adding an attorney who could have worked as an “ally” with a

competent commercial real estate broker… they could have forced that buyer to perform... or step out of the way and let

a real buyer step into his place.

These bad outcomes can happen to anyone... beginner or seasoned veteran and either with or without your attorney’s help.

It doesn’t matter.

Whether it's losing 100's of thousands of dollars like that Bronx owner, or getting tied up in knots like that Brooklyn owner

did due to the complexities of the selling process, you now hold in your hands the blueprint for mitigating these financial

“deadly mistakes”… a blueprint that I have been perfecting for nearly 2 decades … and continue to sharpen and improve upon

in this most difficult and competitive real estate market.

And guess what. It doesn't matter if you own 6 units or 600 units... or if your property is located in Midtown Manhattan

or in the South Bronx! I’ve demonstrated it in in virtually every type of submarket.

When it comes to selling, I’m still amazed that people will take more time planning a weekend get-a-way to the Hamptons than

selling a major part of their net worth like an apartment, office or industrial building.

Vacations usually involve large amounts of comparison shopping, Internet searches, securing flight tickets, maps and driving

directions, weather reports, hotel information, nearby restaurants, parking arrangements, site seeing, what to pack, car inspections,

emergency phone numbers, a sitter for the dog, the list goes on and on.

For many owners however, an unsolicited bid, a casual conversation with a friend who dabbles in real estate or an outdated magazine

article becomes the basis of a multi-million dollar decision. A decision affecting the financial certainty of a deal… or worse yet,

seeing $13,000,000 slip through your fingers.

There are some owners who will NEVER be convinced that a highly trained commercial real estate broker with a track record

of over a billion dollars in sales can facilitate a lucrative transaction. If that’s you, then just grab a drink and just

enjoy a few good deal stories! You’ll still benefit from this report.

The selling process can be daunting... and for the more experienced operator or dealer, it’s still a highly stressful

undertaking with a million moving parts that can go wrong.

The following objectives are what every seller should strive for: (this is assuming that a sale has been determined as

the right course of action and you have a method of mitigating the tax consequences)

Objectives

- PRICE:

To achieve the highest price possible under current market conditions

- TIMING:

To achieve this high price in the shortest time possible...

(or within your required time frame)

- EXECUTION:

To avoid the brain damage of the selling process and increase “deal certainty”.

I'll try to explain them a little further...

PRICE

To achieve the highest price possible under current market conditions.

My SMP method begins with determining the highest listing price possible… without losing credibility. We look at every

possible circumstance and factor that will influence the final sales price.

Unless someone sees a specific purpose for an asset as in an “owner user” situation or there’s some "significant change

of use or zone change" that would warrant a buyer to overpay for a property, it's generally understood that an investor

of real estate is looking for the highest (ROI) “return on his investment”.

Have you ever wondered why someone overpaid for a property. In all my years and research, I can confidently say that if

you dig deep enough into the history of the transaction, there is something that can justify it. Creative financing, a

1031 exchange, refinance money, economies of scale with neighboring properties by consolidation of supers or management

staff, other people’s money (opm)…The possibilities are endless.

With so many choices out there to place your money… stocks, bonds, cd’s, gold... why real estate, then?

Generally speaking, how low of a return a buyer is willing to settle for will determine how high of an offer he is

willing to make. Sometimes an immediate “return” can be overlooked if a buyer sees some “value add” potential or

“upside” as it’s called… but the effort needed for that anticipated future return is still somewhat baked into the offer.

It’s the challenge of a good broker to highlight or accentuate this upside or intrinsic value to a

buyer…thus comfortably elevating his offer.

There are factors both in and out of our control that can affect pricing. These include things like competing listings,

availability of financing, down payment requirements, interest rates, physical condition of the property, recent transfers,

the motivation of sellers, a lender’s criteria, Gov’t regulations, etc.

It’s the broker that can orchestrate these million moving parts to help determine that selling is not only the appropriate

course of action for the client, but how to determine the RIGHT asking price for optimal results. In a sense, the right

asking price is the first and most important step in the marketing process.

TIMING

To achieve this high price in the shortest time possible (or within your required time frame).

Getting a premium price for a property takes time; a specific, multi-step process. Most intelligent investors don't just

wake up and say “I’m going to overpay for a property today”. As a matter of fact, they don’t even want to pay “retail”

for one. They need to be convinced.

Their objective is to find a ‘good deal…’ something under-market or with built in equity. And many of these investors

are “well-funded” and have tremendous “fire power” if the right deal comes along. This ability, and a speedy closing,

may be very alluring to a serious seller and often used a bargaining chip.

There is absolutely nothing wrong or illegal with finding good deals and paying less for an asset if you can move quickly.

But as a “knowledgeable” seller, why not take advantage of the laws of supply and demand combined with a proven method

designed to push the sales price up… and get the same type of speed, if that’s a real requirement. Speed and certainty

should not mean leaving dollars on the table!

During the marketing process, it’s the experienced broker that can clearly demonstrate "hidden" value or upside potential

that doesn’t appear to be self-evident to the average professional. A broker has a way to accentuate positive elements of

a property raising a buyer's expectations (and price).

In this information age, it’s actually quite hard to ‘trick” an investor to overpay for an asset. Even “first time buyers”

will eventually talk to a potential partner, manager, lender, mortgage broker or other real estate agent. So how do you

maintain credibility with so many “advisors” out there?

Successful buyers usually work with a team and rely on many different experts. They may come back with more questions or

they may look at the property two, maybe three times. Most are experts at finding problems… and it’s those very problems

that can tie you up or cut into the price.

If you were looking for a quick deal, these careful investigations may uncover deal killing issues preventing such a time

sensitive transaction. How can you look into the future to pre-empt this?

Another feature of the SMP method is what we refer to as a “physical audit”. This investigation will uncover the pitfalls

or issues that even an experienced owner may overlook about his property since he is so busy managing the day to day.

Let’s be realistic, even a title search could take a week to 10 days! So don’t be fooled by false promises of a one or two

week closing … in return for a costly discount.

More time spent up front doing the research and analysis will SAVE time when the property ultimately hits the market.

If speed isn’t necessary, then a different strategy is required. One that requires a “transparency” that is critical to

accommodate a delayed closing. Delayed closings are tough on buyers due to the volatile nature of the lending environment,

opportunity costs, interest rates and “blips” in the economy.

I had a buyer wait nearly 13 months before they closed on a property (a vacant warehouse). The seller insisted on this extra

time to complete a 1031 tax deferred exchange and wind down an existing business that occupied the building. This was an

unusually long request, but a good broker will explore all options and get a buyer to agree so both parties can somehow

benefit from such an arrangement.

EXECUTION (Deal Certainty)

To avoid the brain damage usually associated with selling income producing properties.

We’ve identified some components of selling investment property including, but not limited to:

Strategic pricing, accurate underwriting and financing illustrations, high impact packaging, marketing and advertising,

negotiating, legal issues, discretion during showings, managing a complicated closing process with multiple third party inspections

that can go wrong (engineer, environmental, appraisal)…Oh, and you can throw in fragile egos, nosey tenants and attitudes as well!

Now, picture yourself selling your own property and getting dozens of calls and voice mail messages from investors and brokers

requesting a set up or inspection. This is just the tip of the iceberg.

While you’re facing those challenges of fielding tenant calls, going to court, watching over contractors and other vendors, trying

to shave expenses, collecting rent and navigating all those government agencies we touched upon earlier... You are now supposed to

be your properties biggest cheerleader.

Imagine being seduced by a promising prospect for your property only to find out you've been tied up by a "shark", or you wasted 3 months

with someone who is trying to syndicate the deal… or worse yet, has no money and just attended a "no money down" real estate course!

Meanwhile, your tenant’s doors are being knocked on at all times of the day by the “tire-kickers" who asked you to fax them a “set up” or

rent roll as they potentially disrupt the stability in your building.

I could be wrong, and you may enjoy the process of owning, managing AND selling… but what if you just want to improve your golf game or

better yet, focus on buying your next deal and making more money?

Since this can get extremely frustrating, let’s say you eventually decide to engage the help of the brokerage community. You are now

speaking to several brokers and mistakenly start sending out sensitive building information. Maybe giving out multiple “open” listings.

Have you ever seen a set up for the same building from 3 or 4 different brokers…with different prices, different expense figures

(and in one case even the wrong picture)?? What a mess.

See Examples on the next two pages.

Confusing? Isn't it?

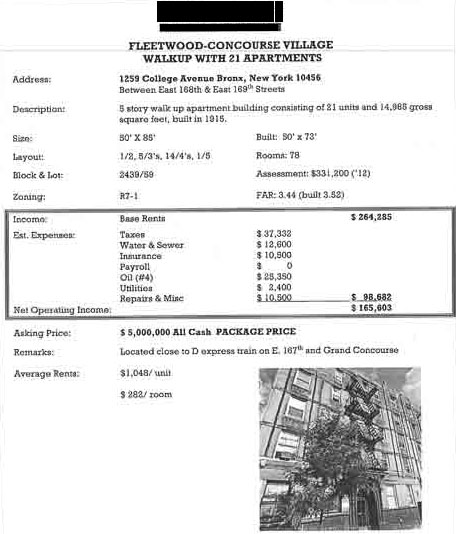

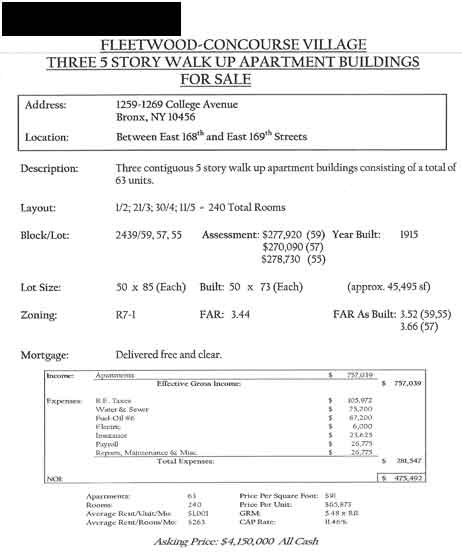

These two seups are actualy for the same real estate offering. Setup #1 has only a 21 unit in the Bronx listed for $5,000,000

(obviously a mistake). Setup #2 has the same building (+ two others) listed for $4,150,000. This is really bad and an

example of how to create confusion and a negative "stigma" for this package of three buildings. The owner actually emailed

me to tell me that he would take $3,950,000 and needed a "quick deal". The confusion and erroneous information only prolonged a

painful process as the seller was at the risk of foreclosure.

The fastest way to stigmatize a property is to put it out there on your own, or worse yet, send income and expense info to a broker

(or two, or three) who then blindly send set ups everywhere without your authorization …Did they demonstrate to you a coherent plan

to implement the 3 critical objectives I just outlined? Do the set ups even correspond with each other? Are they misrepresenting

facts and figures?

Don’t get me wrong. You may get a false sense of security that you’re getting the best representation with a few brokers working on it.

But I can bet that one (or all) of the three primary objectives of Price, Timing and Execution are being incorrectly implement and this

will cost you immensely.

This multiple broker, open listing strategy or “off market”

approach lacks accountability, loyalty, effective resources,

accurate information and may increase the probability of

a very bad deal for you.

…Sounds like common sense right? (You know, like “diversification” or “eating your vegetables”.)

The following case studies involve clients I’ve represented and the many nearby owners of similar properties who didn’t have the

opportunity to work with me …

III| Case Studies: (Actual Proof)

If you think all brokers are the same, you will be shocked. The following case studies show what happens when you use just any

real estate agent... or no agent at all. I've picked numerous examples (some recent and some past) of how my highly specialized

SMP method for selling investment property has helped my clients net the highest price possible for their building.

...And, of course, how their neighbors who didn’t use me lost hundreds of thousands even millions of dollars by ignoring these concepts!

According to the 2010 Housing Supply Report by the NYC Rent Guidelines Board, there were 3,328,395 housing units of

which a staggering 2,144,452 were occupied and vacant rental units! This includes all apartments that are either rent stabilized,

rent controlled or free market.

This incredible density representing 10’s of thousands of buildings in the NYC area is the perfect real life “laboratory” to

demonstrate- with “statistical certainty"- how effective my marketing process is when matched with the traditional way property

is typically sold in this area.

Even the most highly trained statistician would marvel at the size of this representative sample universe that I have the pleasure

to work with every day of my career!

How do I demonstrate this “statistical certainty”?

I do this by comparing properties I've sold with other properties that have sold on the exact same block, within the same time

frame and under similar circumstances.

My college statistics professor would be so proud of me!

You may think I’m exaggerating or find it hard to believe that someone could leave a million dollars or more on the table by not following

the advice in this special report! Here is the proof in my very first case study.

Case Study #1

515 & 526 W 139th St, New York, NY (Hamilton Heights)

515 & 526 West 139th St

This first case study encompasses most of the elements of my “SMP” method combined with client loyalty and an alliance

between broker, seller and attorney.

What started as a routine calling campaign to owners after a recent sale I made on the upper west side, I eventually listed an 8 building

portfolio for an asking price of $100,000,000.

The landlord mentioned that he turned down an offer of 75 million and felt he can get more. I told him about the incredible price

I just got on a neighboring property and he eventually agreed to meet with me.

This first 10 minute meeting eventually lead to a second 3 ½ hour presentation with the whole family… and an incredible exclusive listing.

After numerous offers on the whole package and individual parcels, (several for 10 million more than he turned down in the past) we

finally agreed to enter into contract on two of the properties with a 1031 buyer who just signed a contract on property they were selling

right off Central Park in w 80’s. They leveraged into our 42 units after they closed on a 17 family. It was the perfect investment strategy...

a win/win for everyone.

Our deal closed at a purchase price of $9,300,000 in December 2013. The gross rent multiple was approaching 14x and over $220,000 per unit.

The properties were (two) 50 foot walkups, mid-block, and 21 units each. They were exceptionally maintained with great layouts and tenants.

Many were college students (the hidden value). City College of NY and Columbia are compressing the rental stock there.

Here’s where it get interesting.

There were 5 other transactions nearby totaling 6 buildings that occurred within a couple of months of each other. One was sold direct,

by owner. The others were negotiated separately by several of my major competitors. It’s hard to argue against my teams

“value added” brokerage experience.

Three of the six buildings were on the exact same block of my subject property, 602, 605 & 607w 139th St. Many would argue that their

locations were superior due to their being “west” of Broadway.

Let’s look at the numbers:

| Address | Units | Price | /Unit | /sf | xRR |

|---|

| 515/526 w 139th | 42 | $9.3M | $221k | $267 | 13.8x |

| 602 w 139th | 28 | $4.4M | $154k | $136 | 10.5x |

| 605/607 w 139th | 42 | $8.5M | $202k | $195 | 11x |

| 145 w 138th | 14+1 | $2.75M | $183k | $241 | - |

| 617 w 141th | 41 Elev. | $6.21M | $151k | $147 | - |

| 629-631 w 138th | 21 | $2.5M | $119k | $143 | - |

We beat every metric that our competitors were able to achieve.

My team at RM Friedland, consisting of my brother Jack Lala and first cousin Dave Raciti implemented all the steps

flawlessly for the owner.

I can comfortably say that my SMP method generated between an $800,000 to $1,600,000 premium for my client over my nearest competitor.

And both buyer and seller made a great deal!

We’re just getting started!

Case Study #2

12 building portfolio: Manhattan Bronx Westchester

Take a look at the following unsolicited offers for this amazing 12 building portfolio

Buyer making low Ball offer (#1)

Broker making low ball offer (#2)

Broker making $80 million offer (#3)

Broker making $88.7 million offer (#4)

These offers were provided to us by the owners, along with nearly 100 pages of solicitations from other buyers and brokers right before

they hired us exclusively. This was a marketing “Gold MINE” for our team.This package eventually sold for $109,000,000, yet they

were getting bids between 47 & 88 million! This is a whopping $20,000,000 to $50,000,000 more than any offer received by

the owners directly from both multiple brokers working on an open basis and through “off market” methods.

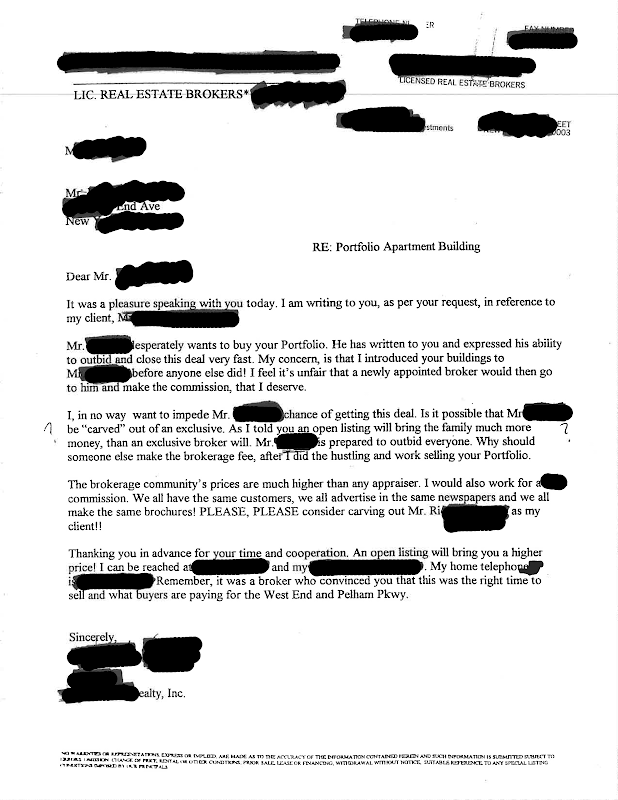

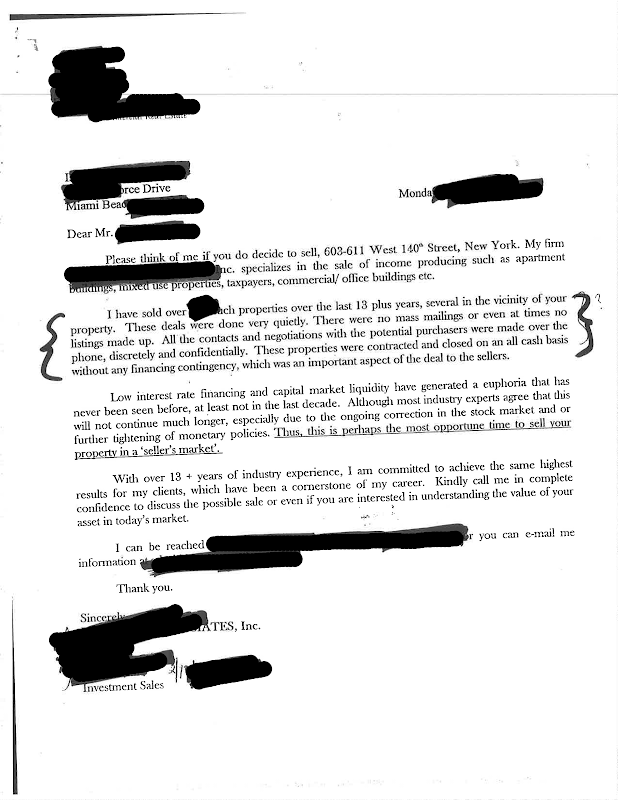

Now study the approach from some of these sales brokers and buyers through actual copies of their correspondence. Seems desperation,

begging and even deception were par for the course…

This “broker” works for the buyer making the offer and is lying about his relationship

This broker says he did all the work finding the buyer by just naming him!

Buyer asking not to mention his offer!

This broker sells with no listings material!

Just reading some of these letters shows you the lack of professionalism from many agents. Even when it came to soliciting a

NINE figure listing worth over $100,000,000 We obtained nearly 60 offers in the first 30 days! We even negotiated something

called a “Life Estate” for the owners which meant permanent residency in their 7 room Penthouse Suite on 680 West End Avenue as

they enjoyed their twilight years together traveling from Florida to New York.

Case Study #3

3 Building Portfolio in the Bronx

One of my very best clients had accumulated nearly 1,000 units in the North Bronx and Upper Manhattan. I probably sold nearly a

1/3 of those units to them and we developed a great relationship based on trust, integrity and loyalty.

As a NJ based firm however, they began to explore opportunities on the other side of the river eventually selling everything they had in NYC.

The last deal I did for them closed at $6,950,000 for a total of 83 units. They included 2471 Grand Ave and 2 attached walkups on 3343/47

Decatur Ave. Some of the challenges included a large percentage of subsidized tenancy, tiny units, numerous building violations, an illegal

basement unit constructed by their super, and an unusually high water bill on one of the properties. The metrics for this deal were as follows:

| 2471 Grand/3343-45 Decatur | 83 units | $6,950,000 | $83,734/unit | 7x rent |

Many recent Bronx deals of similar quality sold by my competitors

generated the following metrics:

|

| 2174 Davidson Ave | 31 units | $1,965,000 | $63,387/unit | 6x rent |

| 620 E 176th St | 47+3 | $3,800,000 | $76,000/unit | 6.5x rent |

| - |

| 1231 St Lawrence Ave* | 28 units | $2,120,000 | $75,750/unit | |

*this building was put into contract for $1,800,000 ($64,285/unit) and flipped for above price!

My results speak for themselves.

Case Study #4

2 building package I sold on Valentine Ave in the Bronx

Walk-up Package

South of Fordham Rd.

left:

2463 Valentine Ave

25 Apts & 4 Stores

Corner of E 188th St.

right

2310 Valentine Ave

27 Apartments

btw. E183rd & E184th

After almost a year of contacting the owner, he finally agreed to meet with me. It still took several months after that initial

meeting to finally convince him to list with my firm. (You can tell that patience is a virtue in this business!)

Within 48 hours after finalizing the income and expense material, my unique marketing process generated 9 QUALIFIED offers for

the package! That’s NINE real offers in 2 days.

The deal was not easy, however. Each property featured not one, but two mortgages. One of the notes was a private loan and the

other was a gov’t backed loan tied into a rehabilitation agreement. High prepayment penalties and an approval process required

a buyer with the right credentials.

We accepted an offer and contracts were drafted. During the negotiations, my client felt a little uneasy about some foot-dragging

on the part of the buyer and we instantly engaged back up offers. I was having “flashbacks” of that Brooklyn owner that was tied

up in knots with that perfect buyer and felt we were heading in the same unfortunate direction. It was the benefits of my

"silent bidding" environment and having multiple, qualified backups however that made the deal.

We didn’t have to put all our eggs in one basket when dealing with that single buyer. One of the backup offers was finally accepted,

without any contingencies and we had at least SEVEN more buyers lined up with equally aggressive offers!

The fact that we had multiple, qualified offers put the seller in a very powerful position. Many sellers end up getting "married"

to a buyer. This is especially true when you're working with a broker on an open basis, or a broker who hasn’t done any formal marketing.

Without a broker and seller acting as allies, the broker doesn’t focus on marketing and his commission is usually riding on just

one deal. There is no incentive to engage other offers or backups, This could possibly expose the property and result in a lost fee! Think about

that for a moment: Without a formal listing, a broker would rather tie you up with an iffy buyer, than risking more time

for another agent to possibly squeeze themselves into a new deal with you.

This is one of the paramount qualities of an exclusive broker who is both legally and ethically obligated to work in your best interest…

unlike multiple, open brokers scrambling to tie you up.

The ultimate purchase price for this package was $2,325,000 on a rent roll of about $464,000. That's about 5 times the rent roll and

approx. 42,000 per unit. A huge premium at the time of this sale as I explain here.

Around the same time, I learned of another property that just sold on the same block. This building is a 41 unit located at

2685 Valentine Ave just north of Fordham Road.

A larger property like this is more attractive to investors…. And since its located north of Fordham Rd, it may also be considered in a

superior location to my 2 exclusive buildings recently sold.

The property was sold for $1,100,000 with a gross income of about $297,000.

The purchase price was LESS than 4 times the rent roll or $26,800 per unit. This was a disastrous deal for the seller. That's one

full multiple less than my recorded sale.

Let's look at the metrics here between the 2 transactions:

2463 & 2310 Valentine

These properties sold for approx. 5 times the rent or almost $42,000 per unit. Nine offers

were generated within 48 hours after implementing my unique, multi-step marketing system. An offer was accepted with multiple,

written back-up offers for the seller.

2685 Valentine

2685 Valentine sold for under 4 times the rent roll or $26,800 per unit. It was sold without the help of a

qualified real estate investment property broker. The difference amounts to almost a half a million dollars in unrealized

purchase price for this owner!

When you're finished with this report, you'll realize that this owner made almost every mistake I outline in this manual...

And it cost him anywhere from 400,000 to 600,000 in additional cash.

What would YOU have been able to do with an additional HALF A MILLION DOLLARS!

Think this is just a fluke? See here how I basically shot past the average market high for the area!

The 26 unit building located on 2314 Valentine Ave. (right next door to my listing on #2310) also sold for about 4 times the

rent along with another property on 265-69 East 194th for a total of 78 Units. The purchase price for this package was $1,725,000

or a little over $22,000/unit.

Here's what that deal looked like...

Valentine & East 194th

The properties 2314 Valentine Ave. and 265-69 East 194th St sold for $1,725,000. The lack of seIler representation cost this

owner a conservative estimate into the hundreds of thousands of dollars. Even a meager $8,000 more per unit (or $30,000)

would have been nearly $600,000 more at closing table.(And this higher $30k/unit price could have still been considered

under market!)

For nearly 2 years, this seller refused to meet with me to discuss my unique marketing formula. And just like the seller

of 2685 Valentine, lost hundreds of thousands of dollars at closing. This totals 3 properties undersold on the same block!

Yes...

Even more empirical evidence of the power of my "SMP" method!

| 2463/2310 Valentine | 52+4 u | $2,325,000 | 5x | $42,000/unit |

| 2685 Valentine Ave | 45 u | $1,100,000 | 3.7x | $24,444/unit |

| 2314 Val/265 E 194 | 78 u | $1,725,000 | 3.8x | $22,000/unit |

Doesn’t this sound familiar? I did the exact same thing on west 139th street as I explained in case study #1… yet these

transactions were done over 10 years apart! Still not convinced?

Most owners just don't trust real estate brokers and we are typically categorized as “untruthful”.

I don't blame all owners however. Brokers are usually guilty of just saying anything or overpricing their evaluations

to get more business so it’s no wonder owners become skeptical or feel deceived.

But I hope you're getting a different sense of what I can bring to the table and a taste of my dedication and passion

to excel. There is also the concept of honor and accountability cultivated over several decades of Martial Arts training

and fighting at an elite level.

Case Study #5

Northern Manhattan

The following example occurred in the Washington Heights submarket of Northern Manhattan.

This submarket has seen dramatic price appreciation and rent growth. Once a haven for drug dealers, its reasonable

(yet ever increasing) rents for one, two and three bedroom apartments have attracted many young professionals who have

been priced out of downtown’s skyrocketing Free Market rents.

The subject property I sold was on 90 Ellwood St. between Nagle and Sherman Avenues. It features 60 units and did not show

very well at all. It also came with the stigma of being "east of Broadway". There's an unwritten rule in upper Manhattan that

properties west of Broadway are considered more desirable.

The seller just bought the building about a year before for $2,000,000 so it was still fresh in the minds of many local investors.

It also came with over 400 violations and a rent collection problem. This was not one of my easier projects.

He did agree to meet with me for a consultation and after just a few minutes, realized that I had the formula needed to help generate

a premium price for him. I discussed how I would position the property and would emphasize how he reduced the number of violations

and began a turnaround of the asset.

We sold the building for $2,300,000 with a rent roll of $396,000. This was 5.8 times the rent or over $38,000 per unit… a new

"watermark" for this location and for such a property at that time. (Keep in mind that I also generated $300,000 more than

what he just paid for the building!)

To use another “same area” comparison, the 52 unit building directly across the street (85 Ellwood) along with another 68 unit

around the comer (68 Thayer) sold for $3,850,000. The rent roll for this package of 120 apartments was $740,000. As you’ll see,

another BAD deal for the seller.

That's about 5.2 times the rent or $32,000 per unit. The properties were in superior condition with new roofs, mail boxes and

other capital improvements. This 6 tenths of 1 multiple difference as compared to my deal amounts to a whopping $445,000 cash

this owner left on the table.

I believe I could have earned this owner even more money since a larger package of 120 units becomes a lot more attractive to

local investors… and I just sold an inferior property nearby for more money.

What was so different between these two deals?

What could possibly cause two similar properties literally facing each other, on the same street, sell for such a different price?

And, the better property was on the market LONGER, ultimately selling for LESS money!

It's the difference between my unique SMP method vs. the open listing method.

Remember, many brokers peddling erroneous information to a limited group of "bottom feeding" buyers can NOT give you the exposure

required for premium pricing and deal certainty. It’s impossible.

Here's what my Northern Manhattan case study looks like:

90 Ellwood Street

90 Ellwood St., NYC

My unique marketing system generated a purchase price of $2,300,000 on 90 Ellwood St.

This was $300,000 more than what the owner just paid for the property about a year before I sold it for 5.8 x RR.

Ellwood & Thayer

85 Ellwood & 68 Thayer

Due to the lack of owner representation and no formal marketing campaign, the owner of the properties pictured above lost over

$400,000 of potential profit when they closed on this deal. They were on the “open” market longer, in better shape and on the

same block, but sold for LESS than my “inferior” listing! (5.2 x RR)

Are you sensing a pattern? Here's more...

Case Study #6

Setups

Although this next example does not involve a comparison between 2 different buildings, it certainly looks that way when you

study these two "set-ups".

What is a set-up?

A "set-up" is the income and expense statement used by brokers to illustrate how a property is operating. Most companies use a

similar format which immediately shows a lack of creativity and gives the building a generic feel when comparing it to other

competing properties. Here's what I mean...

Here was our version (at the time) of a setup for the same building.

The subject property is on 1037 Ogden Ave in the Bronx. It's located just off the comer of 165th street several blocks north

of Yankee Stadium.

I sold the building for a full $125,000 more than the list price listed by another competing real estate broker.

Although originally marketed at a list price of $600,000. (See the “set-up” illustrated previously) the seller did not receive

a single offer for his building.

I studied the income and expenses and realized that the building was worth at least a $100,000 more.

After several weeks of marketing, offers came in at the $650,000 range. One buyer pushed his offer up to $695,000 causing a

chain reaction of similar offers. I instructed the seller to dig his heels in at the list price and we finally convinced

one buyer to step up to plate and make a full price offer.

The thing that most amazes me is that the other broker's set-up at $600,000 shows more profit due to a lower price and its

“substandard” underwriting, yet wasn’t able to influence a response from the market.

Sometimes even a “good deal” cant sell without having the right broker and marketing behind it.

A common technique many brokers use is to leave out essential expenses as if they may "trick" a buyer into paying a higher

price for the property. Believe me, even if a buyer is unsophisticated enough to make an unrealistic offer on a property, a

mortgage broker, attorney, appraiser or bank rep may eventually suggest their own expenses enlightening that buyer with a dose

of reality (and perpetuating the stereotype of the unscrupulous or ignorant real estate agent).

Nevertheless, notice in my set-up how I have incorporated a vacancy allowance, management fee, reserve fund, legal, accounting

and misc. fees along with proposed conventional financing.

A set-up like this immediately sets the stage for intelligent negotiations with interested prospects and banks love it when it's

time to give quotes and letters of intent since I use similar underwriting criteria.

Case Study #7

"Same street" Comparison | Bronx

Here’s another "same street" comparison I accomplished on Heath Ave in the Kingsbridge Heights section of the Bronx. After

responding to one of my post card mailings, the owner of 2709 Heath Ave. contacted me for one of my FREE evaluations.

Within 24 hours, he had signed an exclusive agreement with me to sell his 37 unit elevator building. We listed the property

at $1,950,000 or over 6 times the rent roll. A record high asking price back then.

Not only were we pushing the high multiple of the rent, but we had surpassed $50,000 per unit for one of the first times ever

in the Bronx (a new watermark for such a property in this area at the time).

I knew this for a fact because the building on 2834 Heath Ave just went into contract at $40,000 per unit. This 65 unit building

had more units and significantly more upside potential at a rental income of almost $130 a month LESS per apartment. This was

another one of those “off market” open deals.

Most major property owners I know were not even aware of this transaction...including the owner of the property attached to it!

When you compare the level of activity for my 37 unit listing with this 65 unit deal, you can clearly see the disadvantage

of not working with a market specialist.

Here's what I mean…

Within ONE week, my marketing system generated 10 offers for 2709 Heath Ave. We ultimately closed at $1,800,000 or approximately

$48,600 per unit. Oh, and we closed within 40 days of executed contracts! That’s almost $9,000 MORE per unit, with a property

that had LESS future income potential, less number of units and on the same block!

This was yet another example of the power of my exclusive SMP marketing system.

Heath vs. Heath

My listing on the left, 2709 Heath Ave., sold for $48,648 per unit and closed in about a month. The 65 unit property on the right

(2834 Heath) sold for about $40,000 per unit. This is another “SAME STREET” example of what happens with the lack of seller

representation in today's fast paced market. The results are indisputable!

Case Study #8

Team Lala vs. the Open Market Deal

Here are the metrics of another “Same Street” transaction for a Team Lala sale vs. an open market sale:

Sheridan vs. Sheridan

My listing on the left, 1530 Sheridan Ave, Bronx, sold for $44,117 per unit or 5.5 times rent roll. The property on the right,

1225 Sheridan Ave, sold for approx. $24,259 per unit or 4 times rent roll. Which closing would you like to have been

sitting in if you were the seller?

Clearly, at this point, you can see the tremendous economic benefits of working with an Investment Property Specialist...

a team that has a formal process with a proven track record of success.

Here are a few more examples

There was a 92 unit rooming house I sold on West 97th street for $3,600,000. This was $600,000 over the list

price of $3,000,000. (The seller paid just $450,000 for the property about 24 months before I sold it for him!)

Then there was the 24 unit walkup on West 114th street in Harlem. Although the building still had a coal boiler

and other outdated systems, a bidding war generated an accepted offer at 97% of the list price… within 72 hours!

The buyer owned and managed nearly 100 similar buildings (many within walking distance) and he was not even aware

the property was for sale from the previous marketing efforts of other brokers!

What about the 23 unit walkup with 4 stores on East 220th street in the Bronx. The property was unsuccessfully

marketed by numerous brokers on an open basis for over one year. I generated an accepted offer just 6 days after

it was exclusively listed with me.

I could go on and on with how powerful my marketing system really is.

And if you want more details on how I helped these sellers avoid the deadly mistakes building owners make when

it came time to sell, just give me a call.

Just what are these deadly mistakes that have cost owners millions of dollars or got them tied up in knots with

a fickle buyer? Let's get into some...

IV| The Deadly Mistakes

Pricing your property incorrectly

One of the biggest problems with prospective sellers is their objection to getting my “professional pricing

evaluation and consultation”.

I'm talking about a kind of "counseling session" that goes beyond just a discussion of price. I bring years of

"seller oriented" deal making to the table giving you a full accounting of what to expect and how to benefit most from it.

This is a refreshing, yet brutally honest look at your property from top to bottom.

Without such a realistic understanding of what to expect and what your property is worth, you cannot determine what you exposure is.

There are tax implications, capital gains guidelines as well as personal and professional consequences that you may never have thought of.

Maybe selling is not a good idea. For example, if you thought your property was worth 2 million, but I came up with a value of

1 million I probably couldn’t help you much. More importantly, how does a valuation of 50% less than what you thought you

would get effect your decision making process?

It may sound strange coming from a broker, but I have actually talked people out of selling their property.

It will be comforting for you to know that I won't pressure you to do anything, except make an intelligent decision

based on grounded information.

What are some erroneous ways an owner may come up with a price or value for their property?

Brokers or buyers giving you unsolicited offers over the phone or in the mail.

These "phone or mailed in offers" usually have hidden agendas attached to them and are not indicative of the true value

of your property. (Remember case study #2)

They may be trying to smoke you out or determine your motivation levels. Or worse yet, get you to give income and expense

information that becomes the basis of a "set-up" that is then disseminated all over town… and quite possibly without your

authorization or financial accuracy.

Sometimes, a broker or buyer may break down a seller and get lucky with a successful "low ball" offer that helps them pick up a “bargain”.

An even more deceptive tactic is to make a "seductive," overpriced offer designed to tie you up into contract. Eventually,

over time, multiple rounds of renegotiations, threats and price reduction requests are made to soften you up.

Think about it for a moment. Can you get a legitimate, qualified offer from someone who has not even inspected your

property or analyzed your income and expenses? This could be a recipe for disaster.

Your next door neighbor has made offers on your property for the past 5 years.

Most "neighbors" make an offer based on the PAST... as opposed to looking into the future. They may even see themselves

as the only real prospect for the asset and try to negotiate from a falsely perceived “upper hand” since there is no outside

competition. And since no broker is involved you‘re also expected to “discount” the price even further due to a lack of a commission.

On many occasions, I’ve had a neighbor actually step up and pay a record setting price due to the introduction of my formal

marketing campaign and competing offers from syndications, funds, 1031 buyers or investors sitting on a war chest of refinance cash.

What similar properties are being listed for.

You can ask for anything you want for your property... and frankly, most sellers do.

Overpricing a property usually discourages serious buyers as they wait for the market to "beat up" the seller. Or worse, they

buy something else. So using other “asking prices” of similar properties may not be the best gauge of value.

A knowledgeable broker with grounded market information can give you the best, most aggressive list price without losing

credibility and all while ensuring that there is healthy competition for your property. The higher the price for your property,

the less buyer activity and competition there is for your asset.

The best brokers have a track record of coming in very close to the asking price. Typically within 95-97% of the asking price

is an often quoted “industry standard”

That expensive appraisal you just had done on your property

An appraisal can be done for various reasons. If you are personally ordering one for estate or tax purposes, they may tend to

be more conservative. Or maybe you’re trying to buy your partner out and want to convince him to take an offer from you!

What if he’s ordering one to buy YOU out?

Maybe a bank is looking to give you cash for an acquisition or a refinance and may tend to be more aggressive to win your business.

There are numerous reasons to “influence” an appraisal.

How accurate is that?

The evaluation I'm proposing is not an appraisal, per se, but a complete "audit" of everything that affects the value of your property.

In the business, we call it a “Broker Opinion of Value” (BOV) or “Broker Price Opinion” (BPO). It is also referred to as a Comparative

Market Analysis or CMA in the residential Real Estate business. I also like to refer to it as the “street price".

Have you actually read an appraisal? Most will use what I feel is a “caveat” or “disclaimer” language by explaining that the appraised

value is usually the result of a 12 month marketing campaign! Do you know how much the market can change in 12 months? What kind of a

guess is it when you start by say it can happen over the next 12 months? That can be an “eternity” in this business.

My BOV… or street price, is an attempt to blend the strict underwriting standards of an appraisal, with fluid market activity looking

forward maybe 90-180 days. I have to blend “historical” data and sales, with an educated guess as to how the current market will react

to a new listing. How does an appraisal quantify an aggressive “user” or a desperate 1031 buyer? What about competitive bids from

syndications using other peoples money?

If you’re speaking to a broker who will not or cannot provide you with this comprehensive “BOV” analysis for FREE. DO NOT use that broker.

If they do provide you with one, are they just “buying” the listing with an unachievable price?

Even if you think your broker who doesn’t do “valuations” is the best, most qualified professional, you should at least get an idea of how

he will underwrite your property and what industry standards he is using to come up with the suggested price. There have been countless books

and programs on the subject of analyzing income property, so I won’t dwell on that in this short report, but a competent broker should be able

to convey what investors & lenders look for in plain, simple language. My “BOV” accomplishes this.

Elements of an typical analysis include a physical inspection of the subject, a study of income and expenses, a look at similar “on markets”

and ones that recently sold as well as current loan packages, overall economic conditions, submarket dynamics, projections, velocity of

inventory, vacancy/collection issues, absorption rates and on and on. These are all touched upon in a carefully crafted BOV.

Even the best evaluations can be skewed if the data is incorrect

The idea that someone can make an intelligent offer or calculate the right asking price with ball park figures and rounded off

information is a huge mistake.

If my “net operating income” calculation is off by a small number like say $20,000 because of your inability to give me accurate

information, then that can skew my value by as much as $286,000 at even a modest 7% “cap” return. Make that a 4.5% cap rate return and it’s almost $450,000!

Remember the saying? "Garbage in - Garbage out"

Here is my saying:

An offer (or BOV) is only as good as the information that was provided to generate that offer (or BOV).

Some owners will go as far as fudging numbers, only to get caught with their pants down at the eleventh hour of negotiations.

False information, or not disclosing any major physical or financial problems, can mean immediate price reductions… or even litigation.

Don’t worry. You won't be audited by the IRS to get workable numbers. A simple unit by unit rent roll with apartment sizes and

lease expirations are very helpful. Also, the basic expense figures are required for a realistic analysis. This could be provided

on the "back of an envelope" as they say in the business.

The wrong attorney can stop a deal dead in its tracks

I've met some extremely competent, high level lawyers that are worth their weight in gold. But then, there are those that just have

no right practicing real estate.

One attorney actually told me point blank that he has 6 lawyers working for him that are specifically instructed to find "deal killing"

items in a contract in an effort to drag the contract out and hopefully create an environment for renegotiations and more billable hours.

It almost worked for one of his clients who I was selling a rooming house to in Manhattan, but when they were looking for their second

$25,000 price reduction the day before the closing, things went bad quickly. The buyer refused to close, the seller sued and two years

later, the buyer lost his $50,000 deposit and legal fees. Not only did he lose his deposit and legal fees, he missed out on nearly

$5,000,000 in appreciation since that deal was located 1 block off Central Park in the west 100’s! He had his great attorney to thank for that.

Another big problem can be the responsiveness of either council. A seller's attorney should be capable of drafting a contract within

24 to 72 hours... NOT WEEKS.

Typically, the larger deals may require more time, but I've seen a lawyer churn out a boiler plate contract within hours.

Legal descriptions, certified rent rolls and other addendum can always be attached subsequently to the main draft.

Getting a quick draft out to the other side can also uncover how “real” a buyer is when the attorney’s comments are returned to us.

If the deal is changed significantly, it could be an indication that the buyer has different intentions, maybe the beginning stages

of a re-trade and a clue to be ready to engage back up offers if the buyer gets more aggressive with his requests.

I normally recommend a sit-down contract signing after the attorneys have ironed out most of the terms. It’s not required,

and usually up to the lawyers, but sometimes it’s the most effective.

I can't always put the blame on the attorney however.

Problems arise when lawyers try to negotiate business points as well as legal points. This is typically due to a broker’s inability

to negotiate beyond the purchase price.

Just getting a price is not a real offer. Offers involve good faith deposits, inspections, record and financing contingencies.

Due diligence “time lines” and mortgage terms should normally be ironed out before a lawyer is even contacted.

If a broker can’t navigate these deal points, your lawyer may have to.

Most "open listing" brokers are purposely hesitant to negotiate aggressively with buyers for fear of losing the deal...

or the buyer. They are less concerned about your terms or the specific deal points and more concerned about losing a

commission. They may even try tying up your deal to attain some control.

Many brokers have actually told me that getting an owner into contract is like getting an exclusive. Did you read that carefully??

It gives them some breathing room to speak to other buyers if the deal starts falling apart.

How’s that for lack of representation! The next time a broker gives you an offer, what are his REAL intentions.

But getting back to lawyers...

It's when the lawyer starts wearing the hat of a broker (whether it be by necessity or choice of a seller) that things can get bad.

A broker will only get paid if the deal closes. An attorney will start charging you when he picks up your phone call,

whether you close or not!! Who do you think will have more incentive to get your deal closed quicker?

A good lawyer can be both tough, representing his client's best interest, while at the same time negotiate with a

"deal making" mentality. I've seen real pro's in action and I can't emphasize enough how important a good real estate lawyer is.

Selling on your own

Unless you have an extensive background in selling investment property, you may want to consider using the services of a real

professional. If you haven’t figured that out by now!

Owning investment property doesn't necessarily make you qualified to sell it. This has more to do with the resources that are

available to full time brokers. I’ve met owners who know more about real estate in their pinkie finger than I do, yet they are

not “marketers” or trained in the “brokerage” arts.

It may actually be prudent to have a "buffer" between you and the multitude of prospects that have an interest in buying your building.

In extreme cases, I've seen sellers get emotional and even explode at the smallest negative comment about their property.

This certainly does not set the stage for successful negotiations. I’ve seen a principle turn down an opportunity when things got

too personal between buyer and seller. Negotiating can be like dating… or worse- marriage counseling!

Some of the best brokerage experiences I've had were with owners who are themselves licensed real estate brokers and have allowed

me to implement the full range of services in my SMP method.

They were able to appreciate every stage of my unique process and I definitely saved them countless hours of brain damage and time

away from their other money making responsibilities.

The fee is not even an issue if they know I could generate a 10-20% premium and streamline the process… even if they are getting offers

directly from buyers for their building.

It's very rare, actually, that I meet an owner who hasn’t had an offer on his property before we met.

Although this feels flattering and you may think it's easy, it doesn't come close to a systematic process of getting your property

information in front of a large qualified pool of prospects! And in some circumstances as many as 1,000 – 3,000 prospects in a matter

of hours. You are in the driver’s seat.

This exposure is very difficult to duplicate on your own and takes years and years of networking and closing deals. How broad or how

narrow the campaign is remains entirely up to your discretion and fully outlined in our meeting.

Those instances where I achieved 10, 20 even 50 offers is a result of years and years of focused effort, networking and client relationships.

It’s why I get the business.

Using the wrong broker

If they’ve demonstrated anything at all, my case studies show you what happens when you use the wrong broker.

If a broker can't intelligently discuss the process and complexities of selling income properties ... stay away… especially a broker who

does only residential real estate or apartment rentals.

Residential brokers are usually seduced by the “glamorous side” of negotiating multi-million dollar commercial deals and completely out

of their area of expertise. It’s actually unethical as detailed in Article 11* of the NAR’s (National Association of Realtor’s)

Code of Ethics for a broker to list properties outside of their area of expertise. I’ve turned down many “high end” condo or home

sale opportunities. There are better agents than me in that area of residential real estate. Here is an excerpt of Article 11:

*Article 11

The services which REALTORS® provide to their clients and customers shall conform to the standards of practice and competence which are

reasonably expected in the specific real estate disciplines in which they engage; specifically, residential real estate brokerage, real

property management, commercial and industrial real estate brokerage, land brokerage, real estate appraisal, real estate counseling,

real estate syndication, real estate auction, and international real estate.

REALTORS® shall not undertake to provide specialized professional services concerning a type of property or service that is outside

their field of competence unless they engage the assistance of one who is competent on such types of property or service, or unless

the facts are fully disclosed to the client. Any persons engaged to provide such assistance shall be so identified to the client and

their contribution to the assignment should be set forth. (Amended 1/10)

Another criterion you should focus on is if there is a specific track record of “seller oriented” deals.

I'm not talking just how many deals they've done, but how they specifically represented the SELLER'S best interest in those deals.

Can they document it by case studies, referral letters or even a report like this one?

Most brokers are what I call "buy side" agents, and just don't know the mechanics and subtleties of “seller representation".

Their typical approach is to convince you that they have the ONE perfect guy who is going to pay you a good price… and just trust them to do it.

No evaluation, no comparisons, no rational.

This kind of brokerage is like a doctor writing a prescription for you BEFORE your actual visit!!

Imagine ...no pricing evaluation, no competition or bidding war for your property, offers without accurate information, no marketing campaign,

not even an idea of what your property looks like ... yet this broker has the PERFECT buyer who is prepared to pay millions for you building!

Thanks, but no thanks.

Just look at this solicitation letter that one of my clients received from a competing broker just before he listed his buildings with me.

(see letter on next page)

Would you be more confident with the promise in this letter, or a unique process that generated 9 PREMIUM offers in 48 hours after a

realistic analysis was conducted on your property?

Sometimes, I'm not sure what's worse. Selling on your own or using the wrong broker!

Now you can avoid both.

Learning About Tax Implications

I'm not a CPA, but there are serious tax consequences when selling your property.

If you are generating a huge profit from the sale, you may be vulnerable to a big tax hit. This is especially true if you sell less

than 1 year before you acquired the property.

There are a number of ways to mitigate the tax hit including an installment sale or offering seller financing, a 1031 exchange, or

setting up private trusts.

Many sellers end up paying Uncle Sam after all, but you may want to explore the alternatives or evaluate the true amount of "after tax"

proceeds for your needs with an estate attorney or tax advisor.

Physical Condition

The physical appearance of the property can play a big role in the level of interest from buyers. I've noticed that overall,

people generally take good care of their properties. However, this is not always the case in the secondary or tertiary

areas that I've cover.

Trust me, Urine and human feces in the hallways just don’t show well! But I bet you knew that.

Some low cost/high return suggestions include: A clean, freshly painted lobby; No garbage in the hallways; an uncluttered

basement with easy, well-lit access throughout the property; Silver coated roof; Painted doors. Even strategically placed

paintings, mirrors and plantings can transform a property.

When it comes to the basement, I usually compare it to the human “heart”… and you should take extra care of it.

An owner who goes to the trouble of keeping his basement spotless can automatically give a buyer a great feeling about the

rest of the building before we even get started with the rest of the walkthrough!

Things like broken front doors and windows, glaring structural problems and bad brickwork become negotiating points

(and an indication of more hidden problems).

My initial walk through with you would include some simple recommendations for your particular situation. These will be kept

at a minimum, costing you little or no money. First impressions set the tone for the buyer's visit, and they can be LASTING!

Approach your property in your car like any buyer would. Examine the outside as you're approaching it. How does it look? Is there graffiti?

Broken glass or garbage anywhere?

Is the paint fading or chipping? Is the color outdated or impersonal? How does the parapet wall look? As you drive up to or away,

what do you see first?

Now go inside just like a buyer would. You want to be aware of the 4 senses: smell, touch, sight, and sound. Go through floor by floor

and test all 4 senses. (I advise against the 5th sense of taste however!)

If you have an elevator, don't forget to try the stairs... you may be surprised.

This may seem like overkill for selling your investment property, but I would assume you do this anyway as a

natural part of managing your building.

Management Firms Acting As Selling Brokers

Management companies (like investment property brokers) do not have the best reputations.

My feeling is that as long as they are qualified and focus on doing their job of managing properties, you shouldn't be too

concerned. But only as long as you "manage" the management firm. This can be done with regular meetings, reports… and

unannounced property visits.

When it comes to the decision of selling your property, keep in mind that your management firm is concerned about losing

an account. Although they may be perfectly capable of selling your property… they would typically have one of these three

objectives of their own in mind:

1| Convince you not to sell

Why should you? They will manage the property while you travel the world. Well, one owner I know came back from an extended

Florida vacation only to find that he was days away from losing his building to a foreclosure.

2| Buy your property from you

Can you guess if the management firm controlling all the financial aspects of your building would make you a competitive,

market value offer... or try their hand at bargain basement shopping? Maybe they would run it to the ground... and then

buy it from you. I’m sure they would be glad to take that ailing property of your hands.

3| Broker the deal for you

I learned about a property that was for sale and it was being shown by a leading management firm. Initially, several of its

own managing agents made bids to purchase it, but with no luck. They then tried to sell it to potential clients who would

guarantee that they would keep the management business with them and not hire someone else. There was no regard at all for the

seller’s goal of getting the best deal. When I insisted on making a bid, they assured me that they were not acting as brokers

and would deliver my offer immediately to the seller. It seemed like a long shot so I told them that my buyer would pay my fee to

further entice the seller. Guess what? The management firm tried to make a 6% commission on MY “net-price” offer costing my buyer

the deal and that owner a great offer.

When looking for a qualified professional to manage or sell your property, ask for referrals and do your homework (which includes reading this report).